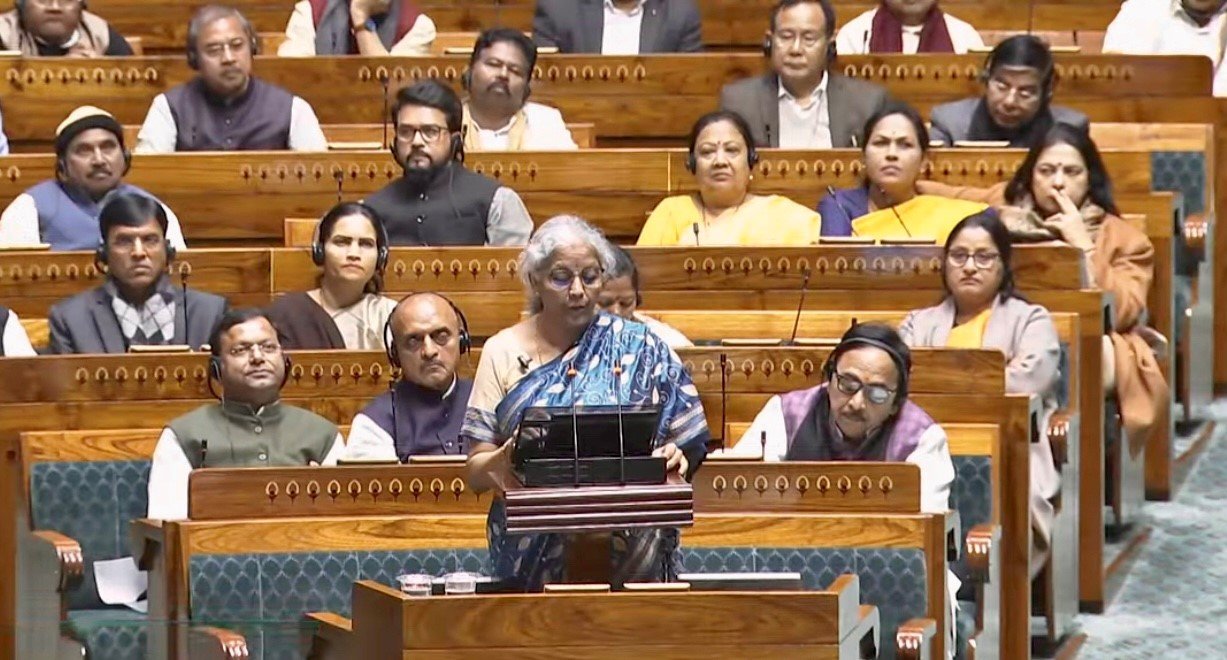

The Union Finance Minister Nirmala Sitharaman on Thursday presented the Interim Union Budget 2024-25 in the Parliament. It was the sixth consecutive budget for Sitharaman. Since it is an election year, the Budget was not presented in full. The next government will present the budget after the Lok Sabha elections.

As per tradition, the Union Minister along with Ministers of State Dr Bhagwat Kishanrao Karad and Pankaj Chaudhary called on President Droupadi Murmu at Rashtrapati Bhavan before making their way to the Parliament.

Prime Minister Narendra Modi hailed the Budget as “not merely an interim budget but an inclusive and innovative budget” and asserted that it “will empower all pillars of developed India – the youth, the poor, women, and farmers.”

Here are some highlights of the Interim Union Budget 2024-25:

Part -1

As per the First Advance Estimates of National Income of FY 2023-24, India’s Real GDP is projected to grow at 7.3 per cent. As per the IMF, India is likely to become the third-largest economy in 2027 in USD at market exchange rate. It also estimates that India’s contribution to global growth will rise by 200 basis points in 5 years.

Sitharaman announced an increase in capital expenditure outlay for the next year by 11.1 per cent to Rs. 11,11,111 crore (3.4 per cent of the GDP). To further strengthen the growth momentum, the scheme of fifty-year interest free loan for capital expenditure to states will be continued this year with total outlay of Rs1.3 lakh crore. A provision of seventy-five thousand crore rupees as fifty-year interest free loan is proposed this year to support the milestone-linked reforms of Viksit Bharat by the State Governments.

The Finance Minister informed that the Revised Estimate of the total receipts other than borrowings is Rs 27.56 lakh crore, of which the tax receipts are Rs 23.24 lakh crore. The Revised Estimate of the total expenditure is Rs 44.90 lakh crore. The revenue receipts at Rs 30.03 lakh crore are expected to be higher than the Budget Estimate, reflecting strong growth momentum and formalization in the economy.

Sitharaman also stated that the gross and net market borrowings through dated securities during 2024-25 are estimated at Rs14.13 and 11.75 lakh crore respectively and both will be less than that in 2023-24. Further, she announced that the FDI inflow during 2014-23 was USD 596 billion marking a golden era and this is twice the inflow during 2005-14.

For encouraging sustained foreign investment, we are negotiating bilateral investment treaties with our foreign partners, in the spirit of ‘first develop India’, the Finance Minister added.

She said that the needs, aspirations, and welfare of the poor, women, youth and farmers were the government’s priority and asserted that the development programmes, in the last ten years, have targeted each and every household and individual, through ‘housing for all’, ‘hargharjal’, electricity for all, cooking gas for all, bank accounts and financial services for all, in record time, she added.

The Finance Minister stressed that this Government is working with an approach to development that is all-round, all-pervasive and all-inclusive. It covers all castes and people at all levels. She said, “We are working to make India a ‘Viksit Bharat’ by 2047. For achieving that goal, we need to improve people’s capability and empower them”.

Announcements

– Government will pay utmost attention to make the eastern region and its people a powerful driver of India’s growth through PM Awas Yojana (Grameen). Rooftop solarization in one crore households will be enabled to obtain up to 300 units free electricity every month.

– A corpus of rupees one lakh crore will be established with fifty-year interest free loan. This will also encourage the private sector to scale up research and innovation significantly in sunrise domains.

– Three major economic railway corridor programmes will be implemented-energy, mineral and cement corridors, port connectivity corridors, and high traffic density corridors. Moreover, forty thousand normal rail bogies will be converted to the Vande Bharat standards to enhance safety, convenience and comfort of passengers.

– Government will form a high-powered committee for an extensive consideration of the challenges arising from fast population growth and demographic changes and the committee will be mandated to make recommendations for addressing these challenges comprehensively in relation to the goal of ‘Viksit Bharat’.

Part-2

No change relating to taxation has been proposed in the Interim Union Budget. The same rates for direct taxes and indirect taxes, including import duties, have been retained. However, to provide continuity in taxation, certain tax benefits to Start-Ups and investments made by sovereign wealth or pension funds as also tax exemptions on certain income of some IFC units have been extended by one year up to 31st March 2025.

Sitharaman announced that improvements will be made in tax payer services, in line with the government’s vision to improve ease of living and ease of doing business. The Interim Budget proposes to withdraw such outstanding direct tax demands up to Rs. 25000 pertaining to the period up to financial year 2009-10 and up to Rs. 10,000 for financial years 2010-11 to 2014-15. This is expected to benefit about a crore tax payers.

Appreciating the tax payers for their support, the Finance Minister said that over the last 10 years the direct tax collections have more than trebled and the return filers swelled to 2.4 times.

On indirect taxes, she said that GST has reduced the compliance burden on trade and industry by unifying the highly fragmented indirect tax regime in India. She highlighted the fact that tax base of GST has more than doubled and average monthly gross GST collection has almost doubled to Rs. 1.66 lakh crore this year. States too have benefited, she said, adding that States’ SGST revenue, including compensation released to states, in the post-GST period of 2017-18 to 2022-23, has achieved a buoyancy of 1.22. Sitharaman

said that the biggest beneficiaries are the consumers as reduction in logistics cost and taxes have brought down prices of most goods and services. Mentioning about a number of steps taken in customs to facilitate international trade, Sitharaman said the import release time declined by 47 per cent to 71 hours at Inland Container Depots, by 28 per cent to 44 hours at air cargo complexes and by 27 per cent to 85 hours at sea ports, over the last four years since 2019.

On the status of Indian economy, the Union Minister said, “In 2014 when our Government assumed the reins, the responsibility to mend the economy step by step and to put the governance systems in order was enormous. The need of the hour was to give hope to the people, to attract investments, and to build support for the much-needed reforms. The Government did that successfully following our strong belief of ‘nation-first’.”

Talking about the economy then and now, she said, “the crisis of those years has been overcome, and the economy has been put firmly on a high sustainable growth path with all-round development.” She announced that the Government will lay a White Paper on table of the House ‘to look at where we were then till 2014 and where we are now, only for the purpose of drawing lessons from the mismanagement of those years.’

Sitharaman further added, “the exemplary track record of governance, development and performance, effective delivery, and ‘Jan Kalyan’ has given the Government trust, confidence and blessings of the people to realize, whatever it takes, the goal of ‘Viksit Bharat’ with good intentions, true dedication and hard work in the coming years and decades.”