The National Bank for Agriculture and Rural Development (NABARD) hosted its State Credit Seminar 2025-26 at Hotel Vivor in Kohima on February 25, 2025. The event was graced by Mhathung Yanthan, Advisor for Agriculture, as the special guest. In his address, Yanthan lauded NABARD for its steadfast dedication to the development of Nagaland, particularly in the realms of agriculture and rural advancement. He highlighted NABARD’s critical role in enhancing institutional credit, building rural infrastructure, and promoting financial inclusion across the state.

Yanthan expressed his appreciation for the seminar and the release of the State Focus Paper (SFP) 2025-26, which outlines Nagaland’s credit potential and developmental priorities. He emphasized the importance of the seminar as a platform to address key challenges and opportunities within the financial ecosystem, urging government departments and banks to collaborate effectively to resolve issues within a defined timeframe.

He also commended NABARD for preparing Potential Linked Credit Plans (PLPs) for each district, which assess growth areas and infrastructure needs. These PLPs, he noted, are vital for decentralized credit planning, aligning institutional credit with developmental potential under the Priority Sector to enhance Ground-Level Credit (GLC) flow.

The State Focus Paper, launched during the event, compiles district-level data and outlines the total credit potential for Nagaland’s Priority Sector. It identifies sectoral constraints and proposes measures to improve GLC flow, serving as a crucial reference document for stakeholders. Yanthan expressed satisfaction that Nagaland had exceeded its GLC target for the Priority Sector in the previous financial year, applauding the banking community’s efforts and urging them to maintain this momentum.

Yanthan underscored the persistent challenge of financial inclusion, calling on the State Level Bankers’ Committee (SLBC) to establish brick-and-mortar branches in the remaining 22 unbanked RD blocks in Nagaland. He specifically highlighted the urgent need for banking services in Wokha District, noting that Chukitong, Wozhuro, and Champang remain unbanked, and Sanis ADC HQ lacks a bank despite repeated requests to the State Bank of India (SBI). He urged the SLBC to consider allotting another bank to Sanis if SBI faces operational challenges.

Nagaland’s favorable climate, fertile soil, and abundant natural resources position it as an ideal hub for agricultural and agro-based enterprises. Yanthan emphasized the vast potential in crops like pineapple, ginger, cardamom, kiwi, dragon fruit, banana, bamboo shoots, leafy vegetables, and forest honey, which offer significant opportunities for value chain development. He also highlighted the untapped potential of tuber crops, such as tapioca, yam, colocasia, and sweet potato, which can be transformed into high-value products through processing, value addition, and market linkages.

Yanthan urged financial institutions to support agripreneurs in this sector by providing credit facilities and technical assistance. He called for innovative approaches to improve GLC flow, including bulk lending to farmers through federations and cooperatives, joint liability group financing, area development schemes, and cluster-based financing for MSMEs.

Further, Yanthan raised concerns about private banks’ reluctance to provide agricultural loans, noting that many branches of HDFC, Axis Bank, ICICI, and Bank of Baroda have almost no agricultural loans. He urged private banks to revisit their policies and play a more proactive role in supporting agriculture and small-scale industries. He also highlighted challenges in disbursing PMEGP loans, which are crucial for micro-entrepreneurs.

Download Nagaland Tribune app on Google Play

Yanthan emphasized the need to expand Rural Self Employment Training Institutes (RSETIs) in Nagaland, which currently has only one in Peren. He appealed for the establishment of RSETIs in every district to skill youth, promote entrepreneurship, and create employment opportunities.

He also highlighted the transformative potential of the cooperative sector, particularly through the computerization of Primary Agricultural Credit Societies (PACS) and the formation of multipurpose PACS. He urged the Nagaland State Cooperative Bank (NSCB) to leverage this initiative to strengthen financial empowerment in rural areas.

Yanthan stressed the importance of digital banking, mobile financial services, and fintech innovations in bridging the gap between financial institutions and remote communities. He called for a collaborative approach among the government, banks, NABARD, and cooperative societies to ensure the successful implementation of credit initiatives.

B. Bulte, General Manager and OIC of NABARD, delivered the inaugural address, highlighting the State Focus Paper’s projection of a credit potential of Rs. 2,106.34 crore under Priority Sector activities for 2025-26. He emphasized the need for banks to focus on extending credit to Farmers Producer Organizations (FPOs) and Primary Agricultural Credit Societies (PACS), as well as fast-tracking the saturation of Kisan Credit Cards (KCCs) with a special focus on animal husbandry and fisheries.

Bulte also highlighted NABARD’s efforts to digitize the Potential Linked Credit Plans, introducing a digital State Focus Paper for more efficient credit projections. This advanced document, he noted, will serve as a guiding tool for financial institutions to enhance ground-level credit flow and foster agricultural term lending.

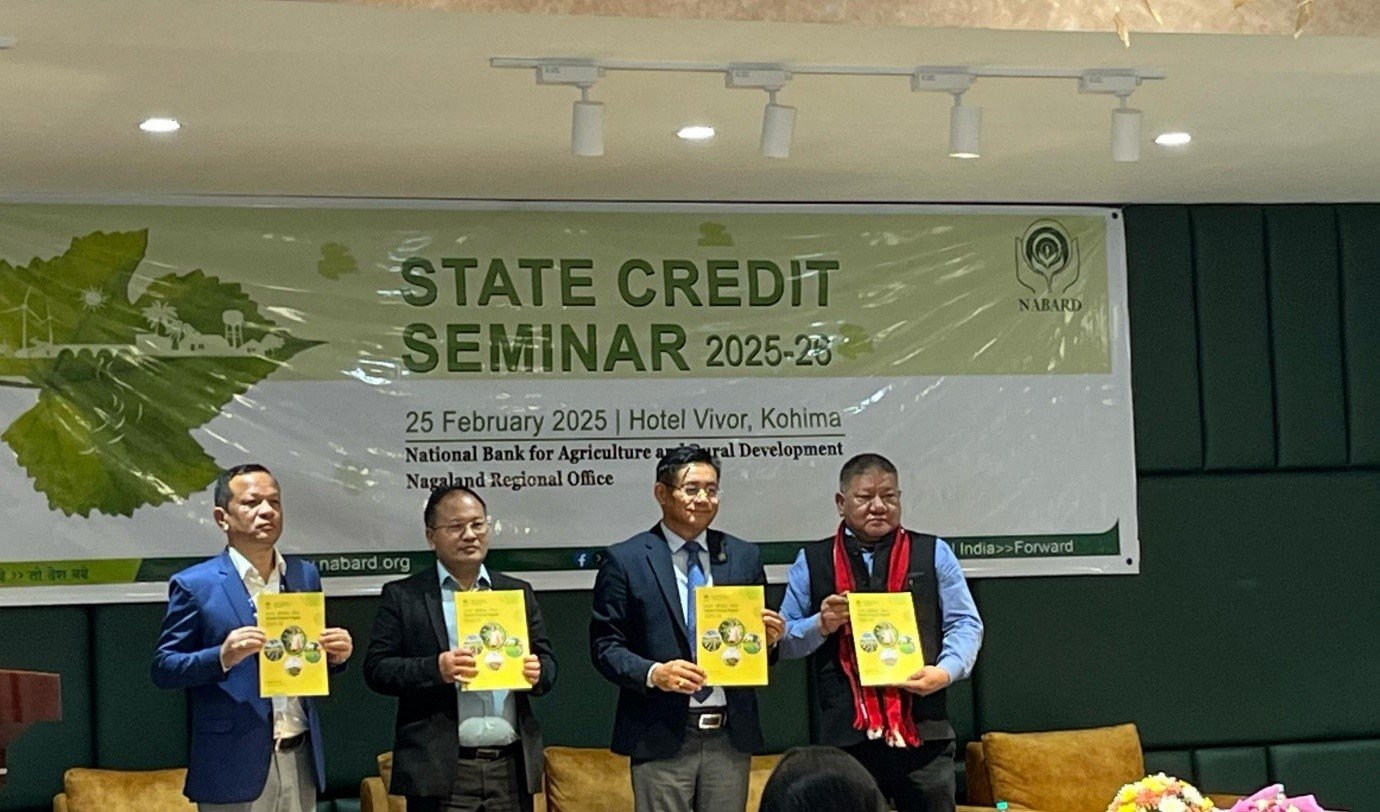

The seminar featured the launch of the State Focus Paper 2025-26 by Advisor Mathung Yanthan, followed by a presentation on the document by Assistant General Manager Bijayashree Parida. State Level Bankers’ Committee (SLBC) Coordinator Lalhlimpuia discussed Priority Sector Lending (PSL), while YouthNet and Community Educational Centre Society (CECS) shared their experiences in various developmental initiatives.