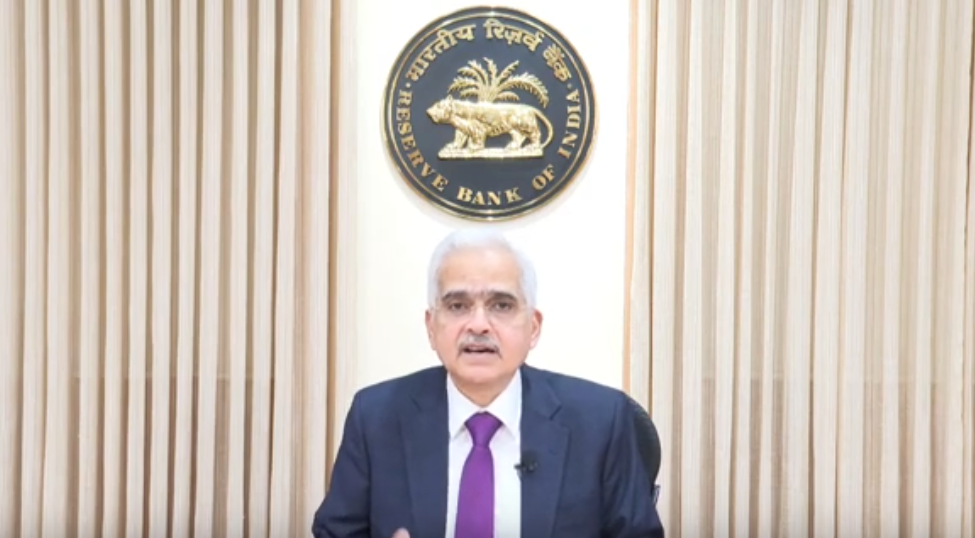

The Reserve Bank of India (RBI) has decided to keep the policy repo rate unchanged at 6.50 per cent, RBI Governor Shaktikanta Das said on Friday as he announced RBI’s Monetary Policy for Financial year 2024-25. He also informed that the bank projects the real GDP growth at 7.0 per cent.

Das explained that the Monetary Policy Committee (MPC) decided to keep the policy rate unchanged at 6.50 per cent because it “remains vigilant to the upside risks to inflation that might derail the path of disinflation.”

He also said that considering the bright agricultural outlook and rural activity, consumer confidence, prospects of investment, persisting and robust government capital expenditure, healthy balance sheets of banks and corporates, improving global growth and trade prospects, the real GDP growth is projected at 7.0 per cent with Q1 at 7.1 per cent; Q2 at 6.9 per cent; Q3 at 7.0 per cent; and Q4 also at 7.0 per cent. The risks are evenly balanced, he added.

The Governor also pointed out that the “headwinds from protracted geopolitical tensions and increasing disruptions in trade routes, however, pose risks to the outlook.”

On inflation, Das said that food price uncertainties continue to weigh on the inflation trajectory going forward. Frequent and overlapping adverse climate shocks pose key upside risks to the outlook on international and domestic food prices, he said, adding that cost push pressures faced by firms are seeing an upward bias after a period of sustained moderation.

Amid the cuts in LPG, petrol and diesel prices, increase in crude oil prices and continuing geo-political tensions, RBI has forecasted the Consumer Price Index inflation for 2024-25 at 4.5 per cent with Q1 at 4.9 per cent; Q2 at 3.8 per cent; Q3 at 4.6 per cent; and Q4 at 4.5 per cent. The risks are evenly balanced, the Governor said.

Mentioning that despite of inflation easing, it still remains above the 4 per cent target. “We would like the elephant (inflation) to return to the forest and remain there on a durable basis,” Das stated. stressing the importance for the CPI inflation to continue to be moderate and align to the target on a durable basis. “Till this is achieved, our task remains unfinished”, the RBI Governor said.