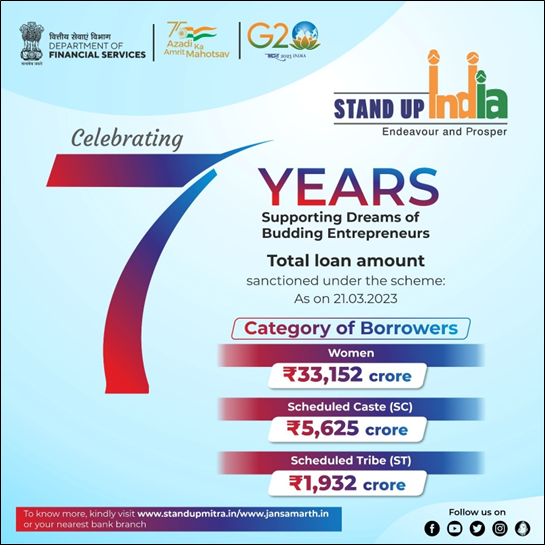

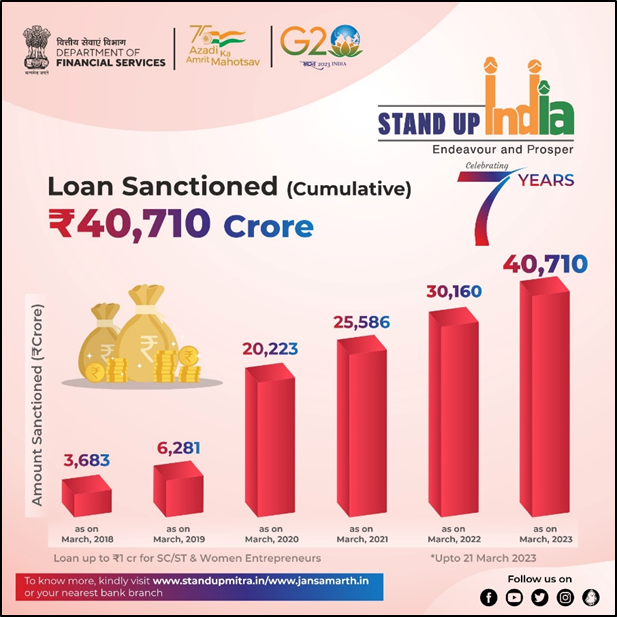

More than Rs. 40,700 crore were sanctioned to over 1,80,630 accounts under Stand-Up India Scheme since its inception, the Ministry of Finance informed on the 7th year anniversary of the Scheme.

Speaking on the occasion, Union Finance & Corporate Affairs Minister Nirmala Sitharaman said, “It is a matter of pride and satisfaction for me to note that more than 1.8 lakh women and SC/ST entrepreneurs have been sanctioned loans for more than Rs. 40,600 crore.”

“The scheme has created an eco-system which facilitates and continues to provide a supportive environment for setting up green field enterprises through access to loans from bank branches of all Scheduled Commercial Banks. Stand-Up India Scheme has proved to be an important milestone in promoting entrepreneurship among SC, ST and women,” she added.

Sitharaman said that Stand-up India Scheme has touched numerous lives by ensuring access to hassle-free affordable credit to the unserved/underserved segment of entrepreneurs. She also said that the scheme has provided wings to aspiring entrepreneurs to showcase their entrepreneurial acumen and the potential entrepreneurs hold in driving economic growth and building a strong ecosystem by being job creators is immense.

Download Nagaland Tribune app on Google Play

Union Minister of State for Finance Dr Bhagwat Kisanrao Karad said, “Stand-up India scheme is based on the third pillar of National Mission for Financial Inclusion namely “Funding the unfunded”. Scheme has ensured availability of seamless credit flow from branches of Schedule Commercial Banks to SC/ST and women entrepreneurs. Scheme has been instrumental in improving the standards of living for entrepreneurs, their employees and their families.”

Dr Karad said, “More than 1.8 lakh entrepreneurs have benefitted from this scheme during past seven years.” “It is also a matter of immense pleasure for me that more than 80% of loans given under this scheme have been provided to women,” he added.

Stand up India Scheme was launched on 5 April 2016 to promote entrepreneurship at grassroot level focusing on economic empowerment and job creation. This scheme has been extended up to the year 2025.

Purpose of Stand-Up India:

- Promote entrepreneurship amongst women, SC & ST category;

- Provide loans for greenfield enterprises in manufacturing, services or the trading sector and activities allied to agriculture;

- Facilitate bank loans between Rs.10 lakh and Rs.100 lakh to at least one Scheduled Caste/ Scheduled Tribe borrower and at least one-woman borrower per bank branch of Scheduled Commercial Banks.

Why Stand-Up India?

The Stand-Up India scheme is designed to address the challenges faced by SC, ST and women entrepreneurs in setting up enterprises, obtaining loans and other support needed from time to time for succeeding in business. The scheme therefore endeavours to create an ecosystem which facilitates and continues to provide a supportive environment to the target segments in doing business.

The scheme aims to encourage all bank branches in extending loans to borrowers from SC, ST and women in setting up their own greenfield enterprise.

The desiring applicants can apply under the scheme:

- Directly at the branch or,

- Through Stand-Up India Portal (www.standupmitra.in) or,

- Through the Lead District Manager (LDM).

Who are eligible for a loan?

- SC/ST and/or women entrepreneurs, above 18 years of age;

- Loans under the scheme are available for only green field projects. Green field signifies, in this context, the first time venture of the beneficiary in manufacturing, services or the trading sector and activities allied to agriculture;

- In case of non-individual enterprises, 51% of the shareholding and controlling stake should be held by either SC/ST and/or Women Entrepreneur;

- Borrowers should not be in default to any bank/financial institution;

- The Scheme envisages ‘up to 15%’ margin money which can be provided in convergence with eligible Central/State schemes. In any case, the borrower shall be required to bring in minimum of 10 % of the project cost as own contribution.

Handholding Support:

Apart from linking prospective borrowers to banks for loans, the online portal www.standupmitra.in developed by Small Industries Development Bank of India (SIDBI) for Stand Up India Scheme is also providing guidance to prospective entrepreneurs in their endeavour to set up business enterprises, starting from training to filling up loan applications, as per bank requirements.

Through a network of more than 8,000 Hand Holding Agencies, this portal facilitates step by step guidance for connecting prospective borrowers to various agencies with specific expertise viz. Skilling Centres, Mentorship support, Entrepreneurship Development Program Centres, District Industries Centre, together with addresses and contact number.